Summit Enters Pennsylvania and Delaware Workers’ Comp Markets: What Agencies Should Know

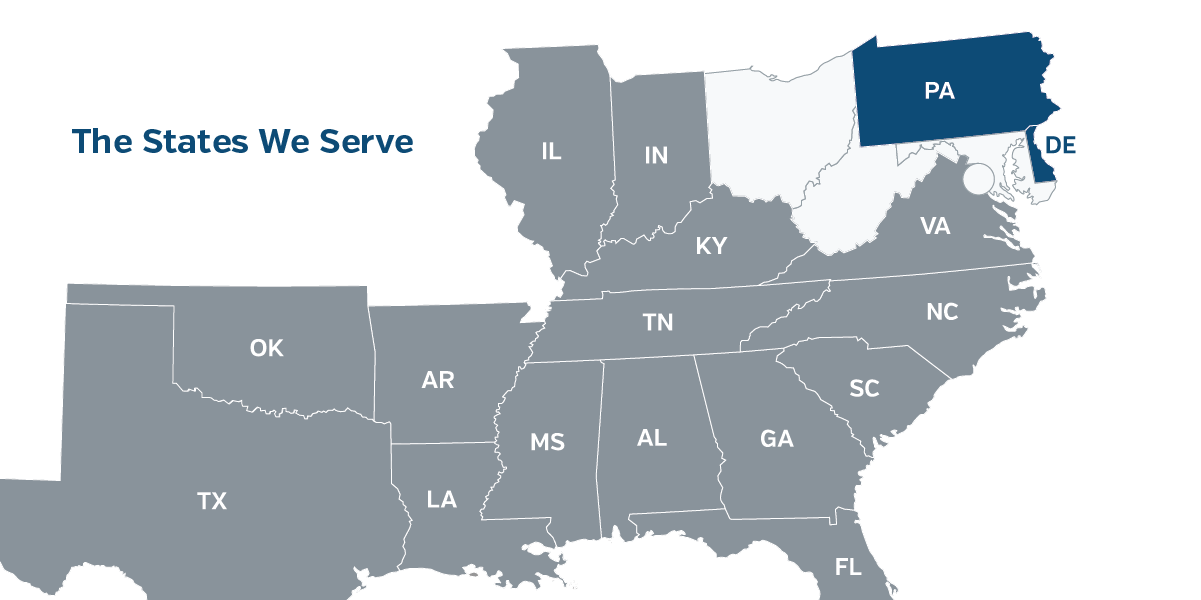

For almost 50 years, Summit has helped independent insurance agencies grow their workers’ compensation business. Now, serving more than 7,000 independent agents and 31,000 policyholders across the South, Midwest, and Mid-Atlantic, we’re launching that same level of expertise and service to Pennsylvania and Delaware.

Here’s why this expansion matters, and how it creates new opportunities for agencies in these markets.

Why Pennsylvania and Delaware?

Pennsylvania is one of the largest workers’ comp markets in the country, with more than $2.5 billion in premium,* and Delaware adds strategic connectivity to surrounding states. Together, Summit’s entry into these states means P&C agencies can work with a carrier that specializes exclusively in workers’ comp—backed by nearly 50 years of experience, in-house claims expertise, and a reputation for responsive service—while staying committed to long-term growth.

Greg Thomas, Vice President for Summit’s Mid-Atlantic Region, explains, “Our expansion strategy is about creating a seamless experience for agencies. Pennsylvania and Delaware are key growth opportunities for agencies in the Mid-Atlantic. Expansion into these states makes it easier for agencies to think of Summit as a leading worker’s comp resource across the region.”

This is the next step in a deliberate regional growth plan that has added states steadily for 20 years. As Greg notes, “We aim to be a competitive carrier in every state we enter. That means investing in local talent, building long-term relationships, and delivering elite service, earning the trust and loyalty of agencies year after year.”

What this means for agencies

When Summit enters a new state, our goal is simple: help make it easy for agencies to succeed from day one. That starts with having people on the ground who understand the local business landscape and can deliver the responsiveness agents expect. Summit believes in creating real connections, because when you work with Summit, you’re working with a team that knows your market and is ready to help you grow. What you can expect:

Broad underwriting appetite

From construction and manufacturing to niche industries, like wood products, Summit writes a wide range of accounts.

As Phil Harrison, business developer for Virginia, puts it, “When agencies learn what Summit brings to the table, the conversation changes. We quote a high percentage of submissions and write a broad range of risks. That flexibility helps agencies win new business and grow their books.”

In-house expertise in every facet of workers’ comp

Claims management, audits, safety, and medical oversight are handled by Summit specialists—not outsourced—so your clients get consistent, responsive service. Our integrated model means fewer handoffs, faster resolutions, and better outcomes. In fact, Summit’s claims approach delivers 35% fewer open claims than the industry average at 18 months post-accident, helping employees recover faster while controlling costs.

Dedicated specialists support your agency

Every agency works with a business developer and underwriter who understand your goals and make every facet of workers’ comp easier. This collaborative approach ensures consistency and responsiveness from quote to renewal.

Agent training and resources

We provide education tailored to your needs, helping your team build confidence in workers’ comp and make informed decisions. As Greg Talbot, SVP of Actuarial and Underwriting, says, “Agents who understand comp make better decisions. We help them get there.”

Competitive compensation and incentives

Summit recognizes and rewards agency success with strong commission structures and performance-based incentives—including incentive trips for top-performing agencies.

High quote ratios

We quote a significant percentage of submissions—often 50–60%—giving agencies more options to present to clients. That means fewer missed opportunities and more chances to win accounts in competitive markets.

Confidence in coverage

Backed by nearly 50 years of experience and a family of AM Best “A” (Excellent) rated, or better, carriers, Summit delivers stability and trust you can count on. Your clients are supported by proven financial strength and a carrier focused solely on workers’ comp.

Why work with Summit?

Independent agents are the lifeblood of Summit. Since 1977, we’ve focused on making workers’ comp simple, profitable, and sustainable for agencies. Our expansion into Pennsylvania and Delaware means agencies who serve those states will experience the same level of attention and service that agents in our existing footprint rave about.

Duke Baldridge, president of Dominion Risk Advisors in Roanoke, Virginia shares his experience since becoming a Summit agent:

“We don’t just want to sign up a new insurance company. We want to make sure they have the products, the services, the people, and the discipline that we need to deliver the promises that we make to our client… Underwriting, claims, and risk control, working all together, is really the value differentiator that helps us attract and retain business. We need carriers who talk the same language, and Summit does that.”

“The question is who is the best carrier to write the workers’ compensation for that client? We very often find that solution is Summit, and that’s why we’ve grown so much.”

– Duke Baldridge, President of Dominion Risk Advisors

What’s next?

If you have clients in Pennsylvania or Delaware, now is the time to start the conversation. Let’s explore how Summit can help you grow.

*Pennsylvania State Activity Report 2024. PowerPoint Presentation (Accessed Dec. 8, 2025).